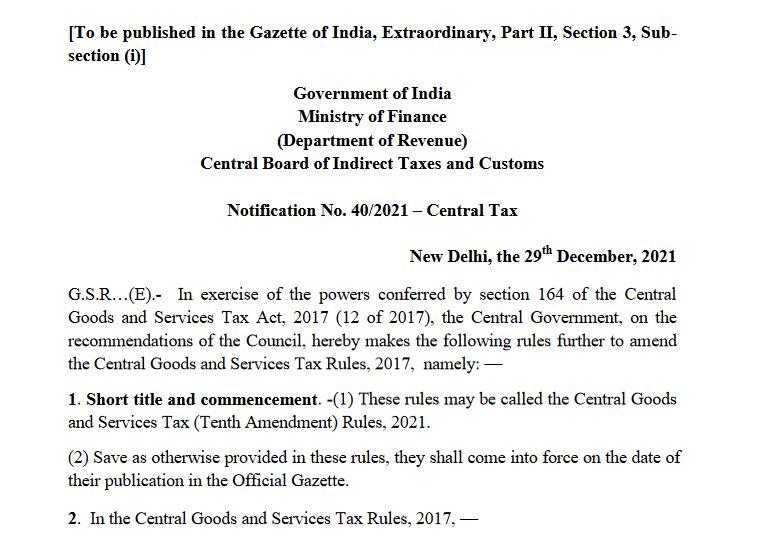

30.12.2021. The GSTR 9 & 9C has been extended till 28th February 2022. Earlier, the last date to file these returns was 31st December 2021. However, after this extension taxpayers will be able to submit these returns by another 2 months. This extension has come through notification no. 40/2021 – Central Tax Dt. 29.12.2021. You may read the complete CGST notification from here.

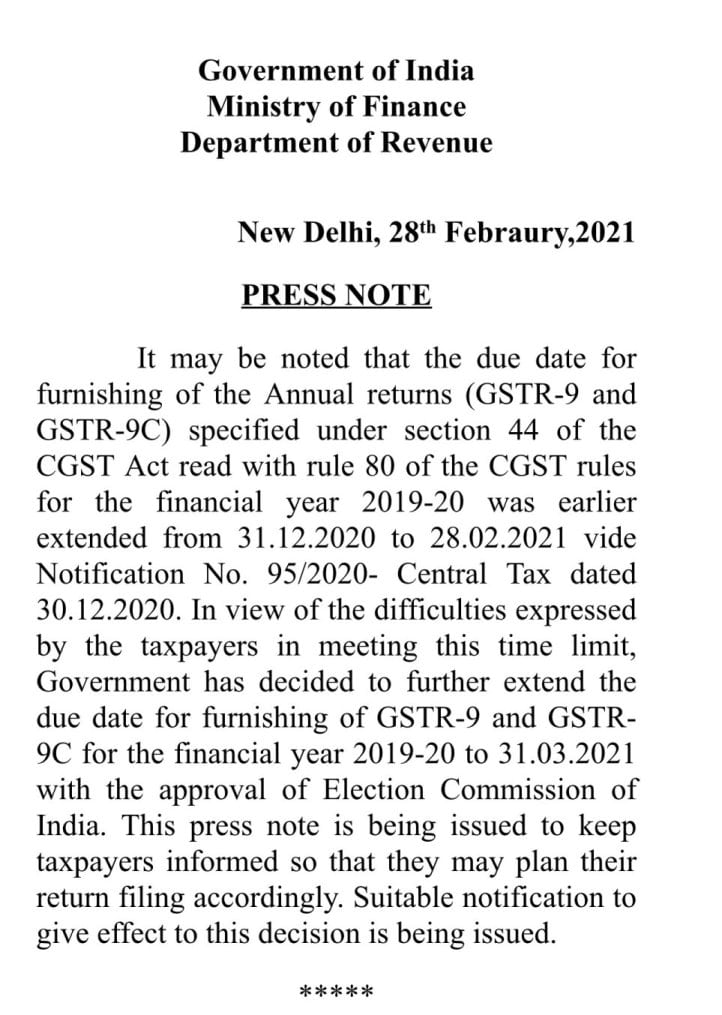

GSTR 9 & Audit Date Extended till 31st March 2021

28.02.2021: The government has finally extended the GSTR 9 and 9C filing till 31st March 2021. The taxpayers have expressed their difficulties in filing these returns within the given time limit. Therefore, now they will able to file these Annual returns until 31.03.2021 without any late fees. Here are the tweet and press releases from CBIC.

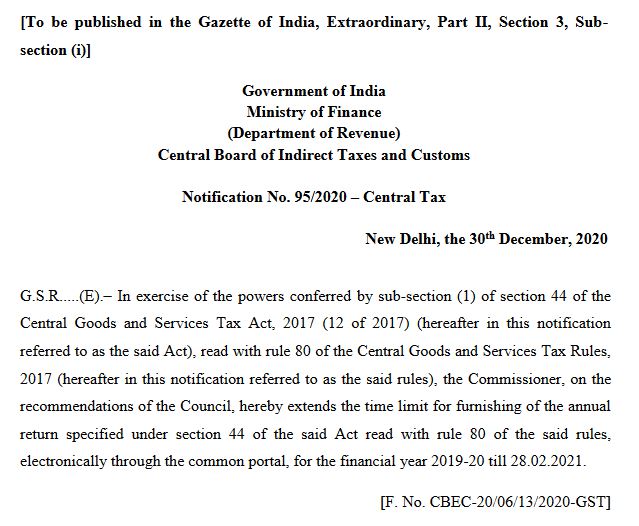

27.02.2021: The GSTR 9 & 9C for FY 2019-20 was due on 31st December 2020 as per the CGST Act 2017. Later the due date was extended till 28th February 2021 as per the Notification No.95/2020–Central Tax dt30.12.2020. However, no further extension is provided for FY 2018-19. Here is the GSTR 9 due date extension notification. Therefore, the taxpayer has last two days to file GST Audit Return with GSTR 9.

The taxpayer should note that the GST Audit Return i.e GSTR 9C is not scrapped of FY 2019-20. However, the government has proposed to scrap GSTR 9c for a future period in the budget held on 1st February 2021.

GSTR 9 & 9C Extension Notification for FY 2018-19

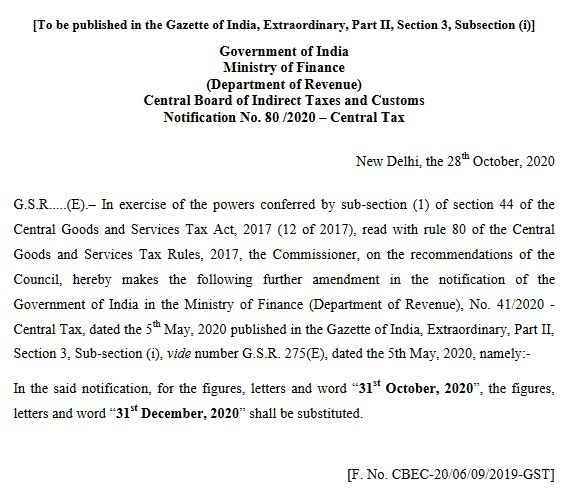

31.10.2020: The government has once again extended the GSTR 9 & 9C Filing date from 31st October to 31st December 2020. Therefore, now those taxpayers who have not yet filed their GST annual returns can file it, within the next two months.

The ministry of finance brought these extensions by considering various representations received from the industry. Here is the official notification issued in this regard.

Read more about GSTR 9 Filing online on the GST portal.

GSTR 9 Due Date Extension Notification FY 2018-19

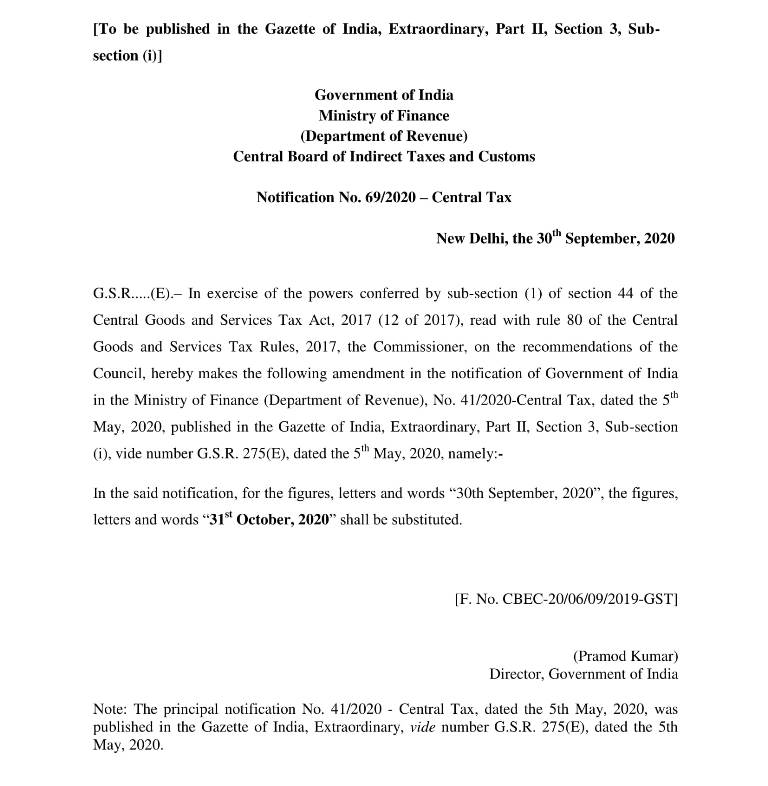

30.09.2020: The Due Date of GSTR 9 & 9C for FY 2018-19 has been extended now till 31st October 2020. Therefore, the taxpayers can now file these returns in another 1 month’s time without paying late fees. Here is the official notification extending GSTR 9 & Audit Date Extension notification.

Earlier, the last date to file GSTR 9 & 9C was 30th September 2020 i.e today. However, it is now extended further by considering the current COVID Situation in the country. The government has not yet notified the extension notification.

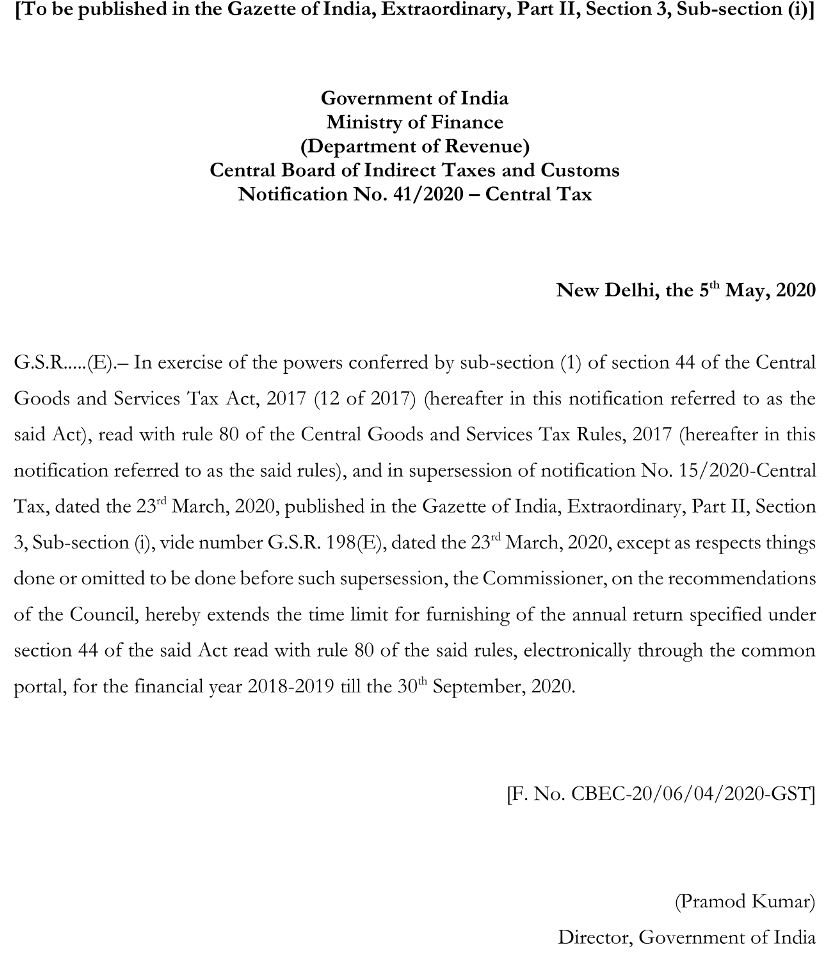

In this regard, earlier the Central Board of Indirect Taxes & Customs has issued a notification to extend the GSTR 9/9C due date, due to the pandemic situation in the country. Therefore, as per the Notification No.41/2020 –Central Tax dt.05.05.2020 the last date to file these annual returns is 30th September 2020. The copy of the notification is as follows. You may also download the notification from the Download notification section.

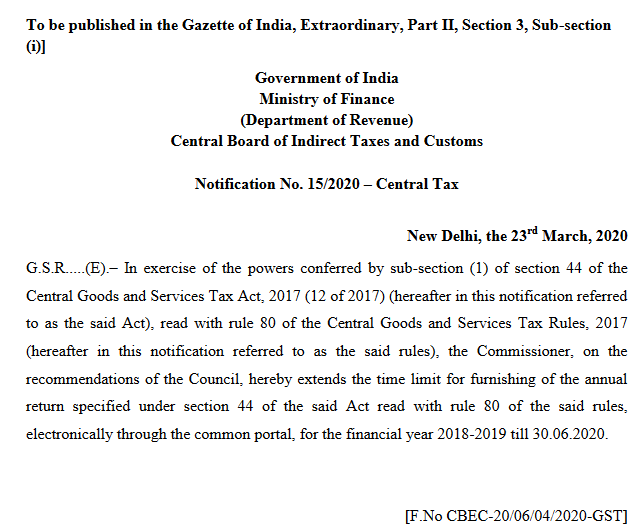

19.03.2020: The Government has extended the previous due dates of filing GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) for Financial Year 2018-19 till 31 March 2020. However, this has been now further extended till 30th June 2020 as per the 39th GST Council meeting decision. Here is the official notification issued in this regard.

Further, the taxpayers will not have to provide a split of input tax credit availed on inputs, input services, and capital goods for FY 2018-19. Also, there will be no need to provide HSN level information of outputs or inputs for the financial year 2018-19. The previous Official GST notification is as follows.

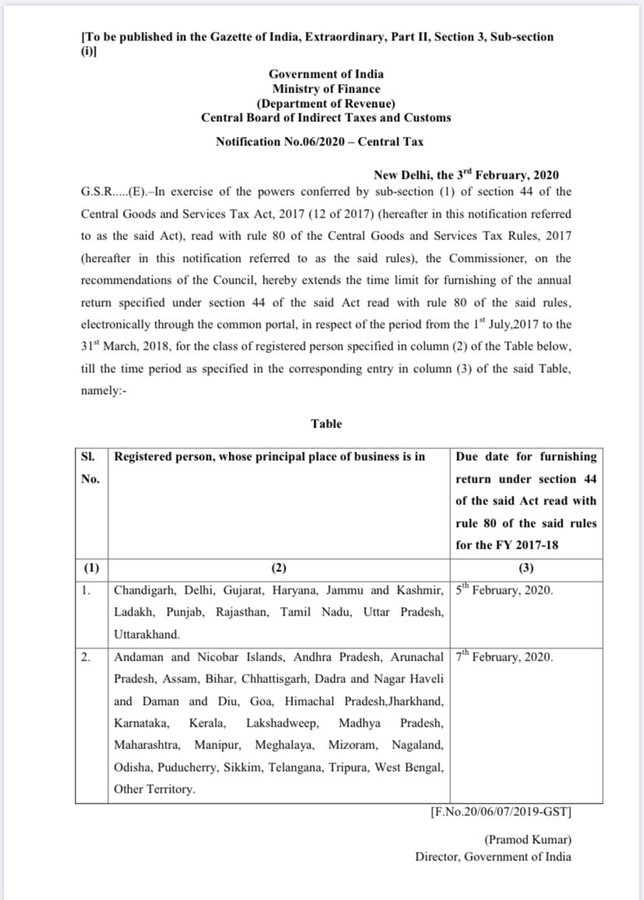

GSTR 9 Due Date Further Extended for specific Group of states For FY 2017-18

03.02.2020-10:20 pm: The CBIC has announced again the extension of GSTR 9 and 9C for certain states till 5th and 7th February 2020.

It is not required to state the reason behind this extension but still, we want to inform the taxpayers that the GST portal was almost down on Saturday and Sunday after the previous extension. Thus, taxpayers could not file their GSTR 9 and 9C to meet the deadline. Here is the revised list of states where this extension will be applicable.

5th February 2020

Chandigarh, Delhi, Gujarat, Haryana, Jammu and Kashmir, Ladakh, Punjab, Rajasthan, Tamil Nadu, Uttar Pradesh, and Uttarakhand.

7th February 2020

Andaman and Nicobar Islands, Andhra Pradesh, Arunachal Pradesh, Assam, Bihar, Chhattisgarh, Dadra and Nagar Haveli, and Daman and Diu, Goa, Himachal Pradesh, Jharkhand, Karnataka, Kerala, Lakshadweep, Madhya Pradesh, and Maharashtra.

Also, applicable for Manipur, Meghalaya, Mizoram, Nagaland, Odisha, Puducherry, Sikkim, Telangana, Tripura, West Bengal, and Other Territory.

Here is today’s official notification in this regard.

31.01.2020-10:55 pm: The CBIC has officially now tweeted to announce the extension of the last date of filing GSTR 9/ 9A and 9C in a staggered manner. The state-wise last dates are as follows.

03Rd February 2020

Group 1: Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Puducherry, Telangana, Andhra Pradesh, Other Territory – 3rd February 2020

05th February 2020

Group 2: Jammu and Kashmir, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Gujarat- 5th February 2020.

07th February 2020

Group 3: Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Andaman & Nicobar Islands, Jharkhand, Odisha, Chhattisgarh, Dadra and Nagar Haveli, and Daman and Diu, Lakshadweep, Madhya Pradesh, Uttar Pradesh- 7th February 2020.

GSTR 9 Due Date Extension Notification for FY 2017-18 till 31st January 2020.

The 38th GST council meeting has recommended extending the GSTR 9 & GSTR 9C till 31st January 2020 for Fy 2017-18. Thus, the CBIC has issued an order no. 10/2019 dt.26th December 2019 to give effect to these recommendations. Therefore, on the basis of this notification, the taxpayers can now file their GSTR 9 and 9C till 31st January 2020.

Similarly, the GSTR 9 also can be filed on or before 31st January 2020 without late fees. However, the GSTR 9A & GSTR 9 return is made optional for turnover up to 2crore vide CGST notification No. 47/2019-Central Tax ,dt. 09-10-2019. Below is the order/notification extending the due date of filing.

Previous Extension

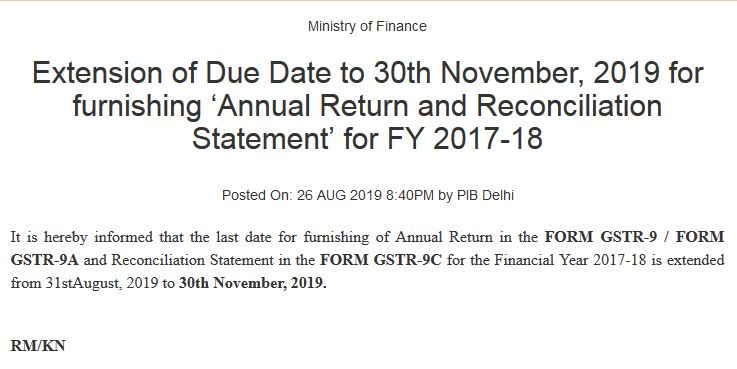

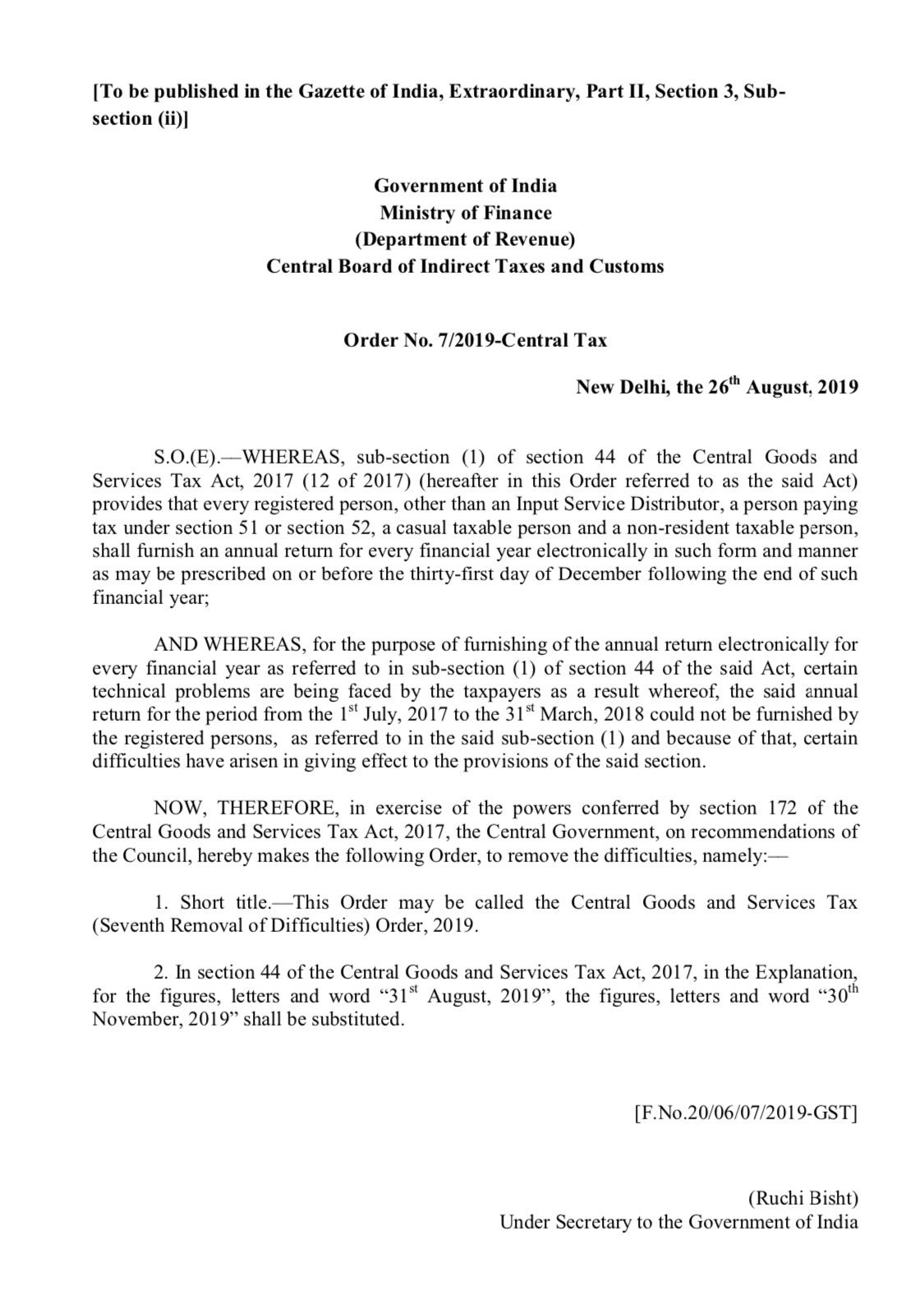

26.08.2019: The Ministry of

Earlier, the previous date was 31.08.2019 as per trailing notification. However, the taxpayers are facing many difficulties to file this Annual Return. On one hand, the offline utilities are completely new to the taxpayers. On the other hand, taxpayers are getting technical errors while uploading a JSON file which carries the GSTR 9 Data.

Thus, now the new deadline is 30th November 2019. Here is the screenshot of the press release and Notification from CBIC. You may also download the below order from GST Notification page in pdf format.

Press Release

Official Order

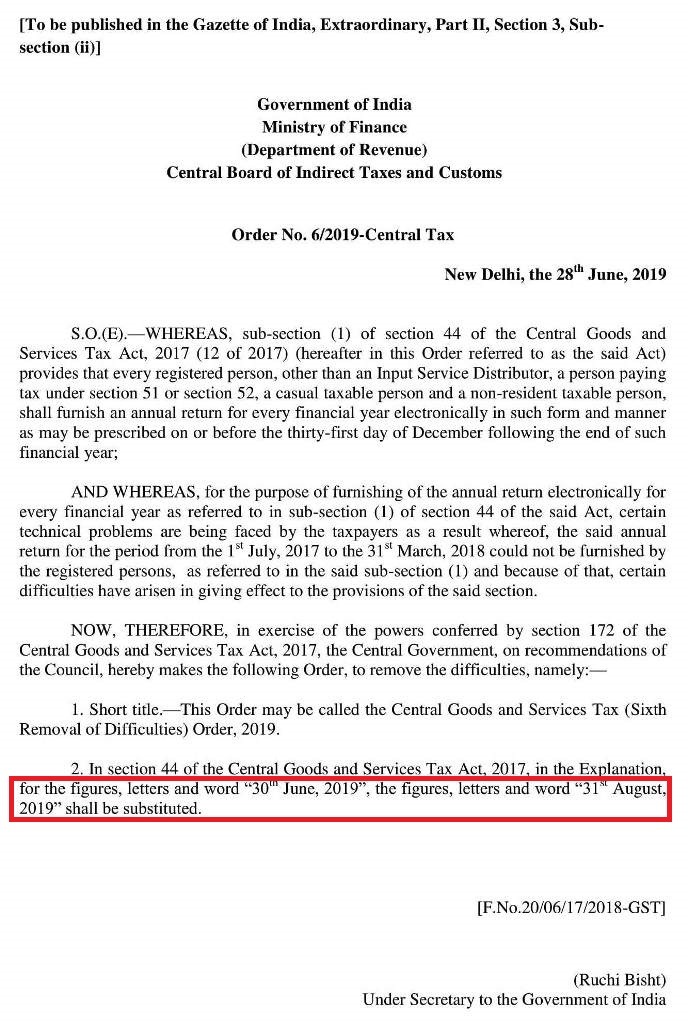

28.06.2019: GSTR 9 & 9A is Now Available for online filing on GST Portal.The 35th GST council meeting has recommended filing of gst annual return extension (GSTR 9/9A and 9C) till 31st August 2019 for Fy 2017-18. Here is the official notification for this change. Please click here to read it in Hindi.

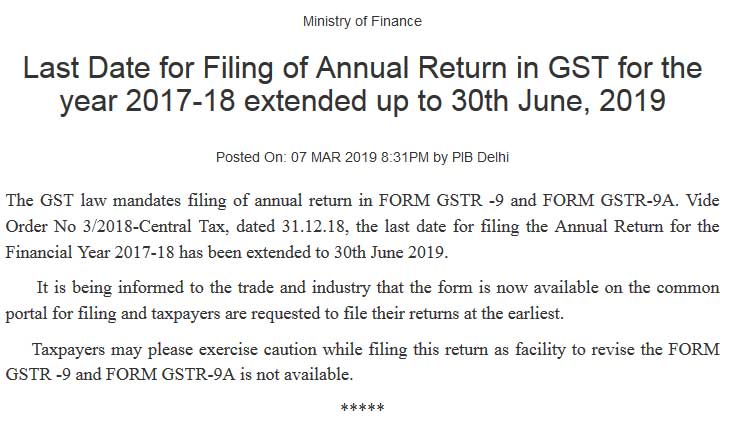

The ministry of finance has issued a press release earlier, informing taxpayers to file GSTR 9 & GSTR 9A Annual Return by 30th June 2019. Therefore, according to the below press release, GSTR 9 & 9A is now available on GST portal for online filing. As per the press release, you need to file GSTR 9 for the period from 01.07.2017 to 31.03.2018 only. However, as of now only online filing system is available. Hence taxpayer can only, file it in live mode.

The offline utility or excel utility is still not available to download on GST portal. The government has requested trade and industry to file this return at the earliest.

No Facility to Revise GSTR 9 and GSTR 9A Annual Return

The government has further said that there is no facility to revise GSTR 9 and GSTR 9 return. Therefore, you should file your return with caution.

So, do not get panic while filing your GSTR 9 and GSTR 9A. Do not get confused and start filling the details in your GSTR 9 return slowly. You may drop your comments below for filing issues, that you face while filing this return. Also, keep visiting our GST News home page to see latest GST updates of GSTR 9 on GST portal.

Check Points before pressing GSTR 9 File button:

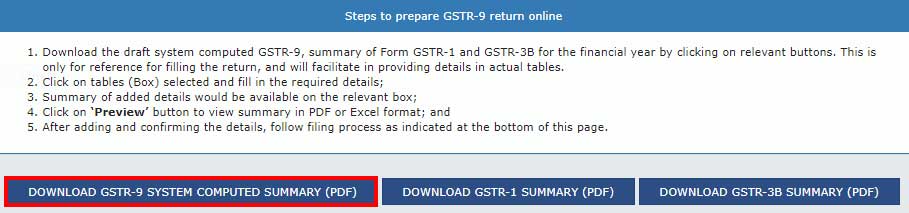

GST Portal will calculate Form GSTR-9 values automatically in different tables. This will be based on Form GSTR-1 and Form GSTR-3B filed by you during the period. These reports are available as a download in PDF format.

Do the following:

- Go To Return Dashboard. Choose to file Annual Return. Click on DOWNLOAD Form GSTR-9 SYSTEM GENERATED COMPUTED SUMMARY IN PDF

- DOWNLOAD Form GSTR-1 SUMMARY IN PDF

- DOWNLOAD Form GSTR-3B SUMMARY IN PDF

- Preview Draft Form GSTR-9 Summary

- Compute Liabilities and Pay Late Fees, If any

- Preview Draft Form GSTR-9

- File Form GSTR-9 with DSC/ EVC

Quick Reference for filing Annual Return

- How to file GSTR 9 online Guide

- How to fill table 4 of GSTR 9

- GSTR 9A filing instructions for composite dealer

- About GSTR 9 Annual Return – offline instructions

GSTR 9 Due Date Extension Notification – File Return by 30th June 2019

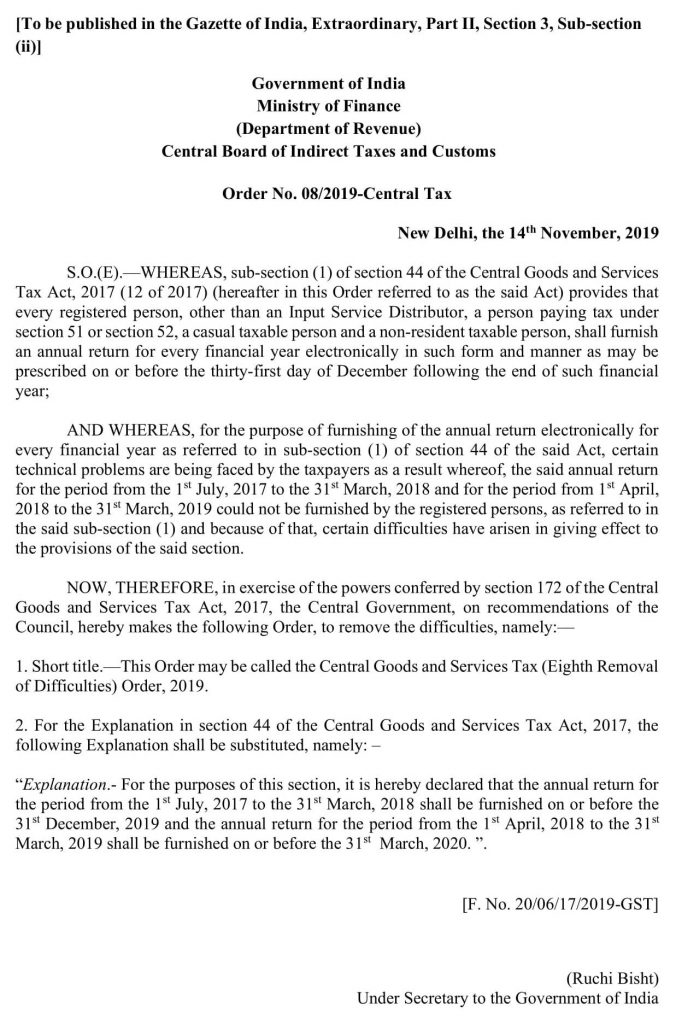

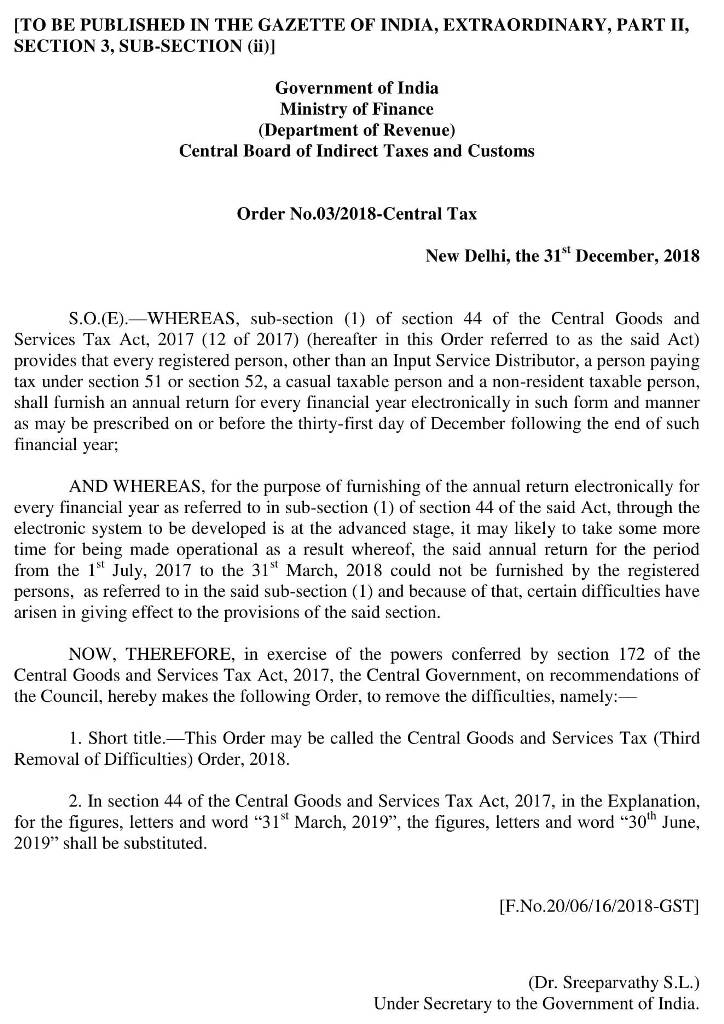

The government has released the order to extend GSTR 9 Annual return filing till 30th June 2019. Here is the GST Notification/order no. 03/2018-Central Tax dt.31.12.2018.

Previous Updates

The due date of filing annual return in form GSTR 9, GST9A, and GSTR 9C has been extended till 31st March 2019. However, this may get further extension till 30th June 2019 as per the latest GST Council’s recommendations. We will notify to you as soon as government release the notification in this regard.

General Questions to GSTR 9 Extension

Yes. The GSTR 9 due date of FY 2019-20 is extended up to 31st March 2021.

31st march 2021.

Do you mean GSTR 9C?. If yes then the last date to file GSTR 9C is 31st March 2021 for FY 2019-20. No extension for FY 2018-19.

Similar Links and Topics

Download GSTR 9C format in Excel

The GSTR 9c format in excel is now available to download on the GST portal. You can download this GST audit report format in excel. more

GST Annual Return Format

You may now download GST Annual format in excel by clicking on the download link. Use the excel template to upload the data on the GST portal. more

GST Annual Return GSTR 9A

Every GST registered person under the Composition scheme in GST shall file an annual return in Form GSTR 9A. more

How to File Annual Return for Fy 2019-20

Follow the simple process to file your GST Annual Return on the GST portal for FY 2019-20. The return must be filed before the last day run’s out. more