As a GST Registered person, How to file GSTR 9 online will be your frequent question. Here is the complete step by step guide to filing your GSTR 9 annual return under GST. This guide will teach you how to fill gstr 9 annual return online. Read more about gstr 9 meaning under Goods and service tax in India. Follow the below steps to file GSTR 9 online by normal Taxpayer.

Quick Links

Login as Normal Taxpayer >>Download summary of GSTR 1, GSTR 3B and GSTR 9- Enter data in various tiles >> Preview Draft summary of GSTR 9

- Compile Liabilities and Pay Late Fee, If any >> Preview Draft of form GSTR-9

- File GSTR 9 Return >>GSTR 9 Checklist >> GSTR 9 video

- Issues and Solutions >> FAQ on GSTR 9

A)Login as Normal Taxpayer

- Visit www.gst.gov.in website. The GST Home page will be displayed

- Login to the GST Portal with your username and password.

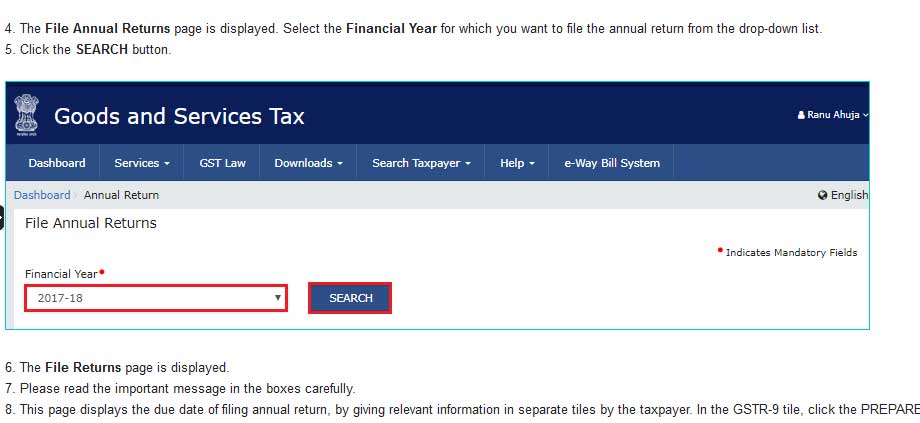

- Click on the Services > Returns > Annual Return command

- Select the financial period

- Select Yes for option 1 to file a nil return and click next.

B)Download the summary of GSTR 1, GSTR 3B, and GSTR 9 form

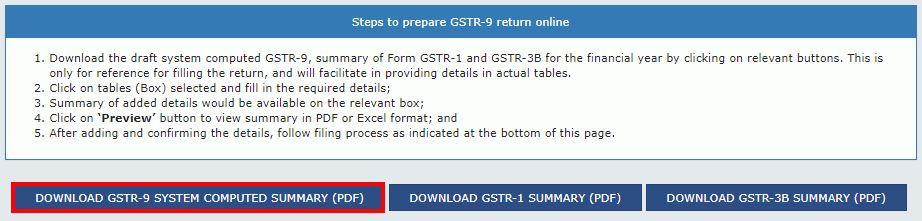

- Here you may download the summary of GSTR 1 and GSTR 3B files by you during the period for which you are filing GSTR 9.

- The default data you see in GSTR 9 tiles are derived from GSTR 1 and GSTR 3B. Therefore you may download these returns in pdf format and compile the data.

- You may also download the summary of GSTR 9 in pdf format.

Download Document wise details of Table 8A

The Government has provided the facility to download the document-wise details of Table 8A for Financial Year 2018-19 onwards. Thus, this will facilitate the taxpayer to reconcile Input Tax Credit (ITC), appearing in table 8A with that of data in GSTR 2A. Here are the quick steps to download the details.

- Login to the GST portal

- Navigate to Services > Returns > Annual Return > Form GSTR-9 (PREPARE ONLINE)

- Click on the DOWNLOAD TABLE 8A DOCUMENT DETAILS option

Further, the option to download these details will be available only once the GSTR-9 tab for filing is enabled. Also, the data saved/submitted in Form GSTR-1/5 will be shown in form GSTR-2A only, and will not be shown in the downloaded Excel file of Table 8A.

C)Enter Data in various tiles

Enter the data in various tiles as below:

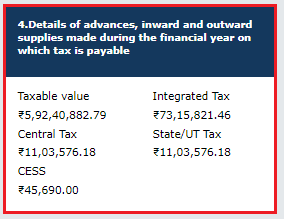

- Table: 4. Details of advances, and inward and outward supplies made during the financial year on which tax is payable. Click on the tile to enter/ view the summary of outward/ inward supplies made during the financial year.

- Table: 5. Details of Outward supplies made during the financial year on which tax is not payable. You may enter/ view the summary of non-taxable outward supplies made during the financial year by clicking on this tile.

- Table 6. Details of ITC availed during the financial year. Click to enter/ view/modify the summary of ITC availed during the financial year

- Table 7. Details of ITC reversed and Ineligible ITC for the financial year: To enter/ view the summary of ITC reversed or ineligible for the financial year

- Table 8. Other ITC related information

- Table 9. Details of tax paid as declared in returns filed during the financial year. Here you can enter/ view the tax (including Interest, Late Fee, Penalty & Others) paid during the financial year.

- Table 10,11,12&13. Details of the previous Financial Year’s transactions reported in the next Financial Year.

- Table 14. Differential tax paid on account of declaration in tables no. 10 & 11.

- Table 15. Particulars of Demands and Refunds

- Table 16. Supplies received from Composition taxpayers, deemed supply by job worker,s and goods sent on an approval basis.

- Table 17. HSN wise summary of Outward Supplies

- Table 18. HSN wise summary of Inward Supplies.

D)Preview Draft summary of GSTR-9

- Click on “PREVIEW DRAFT GSTR-9 PDF” button to download the summary of entered data.

- Click on the “PREVIEW DRAFT GSTR-9 Excel” button to download the summary of entered data in Microsoft Excel.

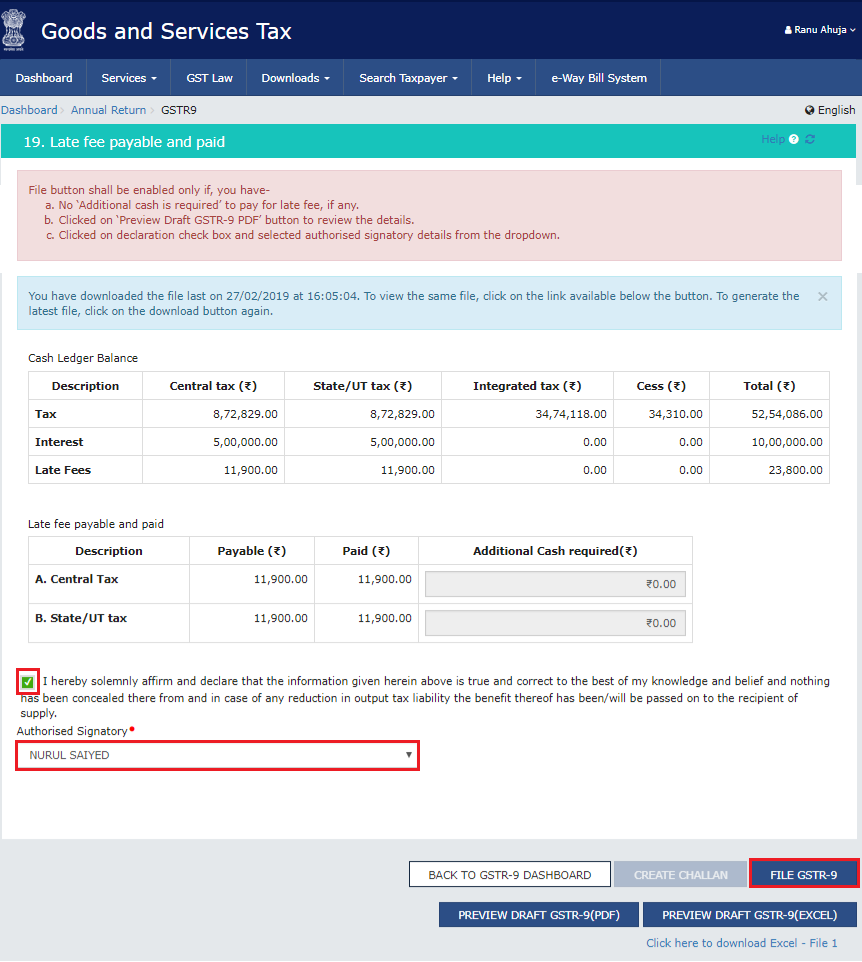

E)Compile Liabilities and Pay Late Fee, If any

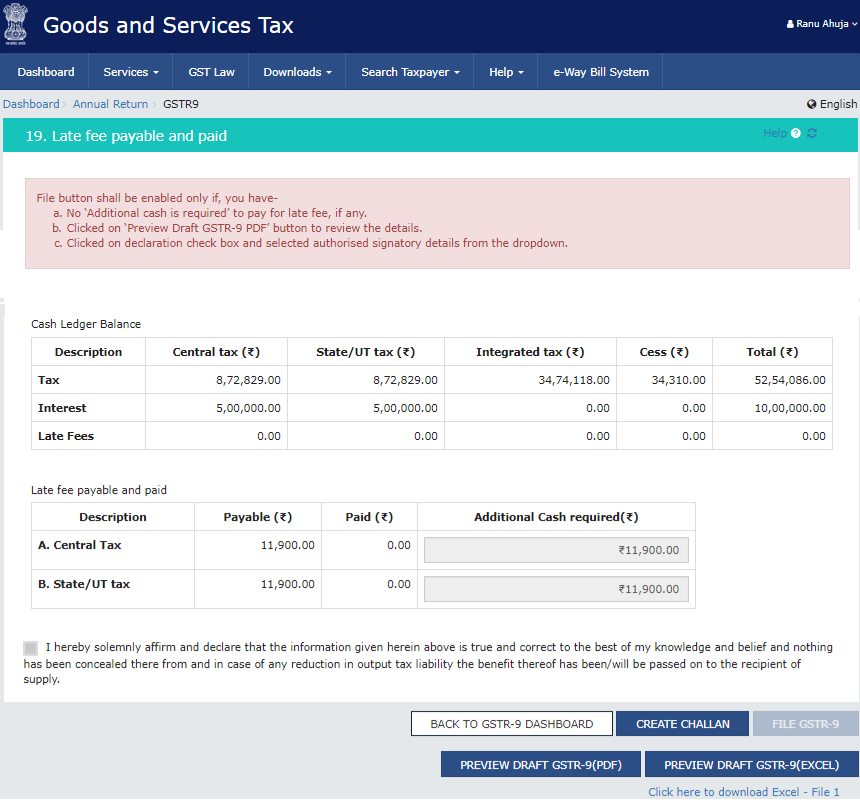

- Click on “COMPUTE LIABILITIES” to calculate late fees if any.

- Click on tile 19. to view the Late fee payable and paid tile or on the “Proceed to File” button.

- you need to have sufficient balance in your cash ledger to pay the late fees/interest if any. You may also create challan on the same screen and pay these amounts.

F)Preview Draft of form GSTR 9

- Click on “PREVIEW DRAFT GSTR-9(PDF)” to see the preview of GSTR 9 in pdf format before filing this return.

- Click on “PREVIEW DRAFT GSTR-9(Excel)” to see the preview of GSTR 9 in Excel format before filing this return.

G)File GSTR 9 Return

- Select to accept the declaration check-box

- Click the FILE GSTR-9 button on this screen.

- Select the Authorized Signatory from the drop-down list.

- Click the FILE GSTR-9 button.

GSTR 9 Checklist – Points to Remember

- Reconcile your GSTR 9 (Annual return under GST) data with accounts and finance department.

- Check for error not corrected in GSTR 1 and GSTR 3B

- Reconcile you GST liability reported in GSTR and GSTR 3B

- Do reconciliation of ITC availment in GSTR 3B with GSTR 2A data. If anything is not reported in GSTR 2A, bring it to notice of supplier and ask them to show in their GSTR 1 Return.

- Compute the ITC admissible and reversal if any.

GSTR 9 Annual Return Video

GST portal has now provided an online filing procedure of GSTR 9 Return. we have an update, we have provided the complete online filing procedure for filing gstr 9 on GST portal.

Issues and Solutions while Filing GSTR 9

Here are some of the issued resolved faced by many taxpayers while filling GSTR 9 return. These steps will clarify how to fill gstr 9 form in offline and online mode. This clarification is prepared by taking the help of many videos and online articles provided by GSTN.

Issue no. 1

The figures of Input Tax Credit (ITC), as pre-populated in table 8A of Form GSTR 9, do not match with the figures as appearing in their Form GSTR 2A. This may happen due to below reasons:

Solution A

Figures in GSTR-2A are auto

In case, GSTR 1 return is not filed by your supplier, then the credit related to those invoices will not appear in table 8A of your GSTR-9.

Solution B

The figures in table 8A of Form GSTR 9 are auto-populated only for those GSTR 1, which are filed by the supplier taxpayer by the due date of its filing i.e. 30th April, 2019.

Hence, ITC on supplies of the financial year 2017-18, if reported after 30th April, 2019, will not get auto-populated in table 8A of GSTR 9 return.

Solution C

In table 8A of GSTR 9 return, only the latest values have been auto-populated based on filed GSTR 1 return, taking into account all the amendments made, if any.

For e.g an invoice with taxable value of Rs 200/- with tax of Rs. 36/- was filed in Form GSTR-1 in the month of January, 2018 and same was amended to Rs 180 as taxable value in the month of March, 2018, then

- The GSTR-2A Return of January, 2018 will show ITC of Rs.36

- The GSTR2A of March, 2018 will show ITC of Rs 32.40 &

- The table 8A of GSTR-9 return will contain ITC of Rs 32.40.

Solution D

In table 8A of GSTR 9, ITC related to all such invoices have been excluded in which place of supply lies in supplier’s taxpayers State, instead of State of the receiver taxpayer.

These figures will be shown in GSTR 2A of the recipient. For example, if a taxpayer of State X visits State Y and stays in a hotel in State Y, the tax paid by him to the hotel in State Y will appear in his GSTR 2A, but the same will not be reflected in table 8A of GSTR 9.

Solution E

The Figures in table 8A of GSTR-9 do not contain ITC for the period during which the recipient taxpayer was under composition scheme.

Issue no. 2

Proceed to file button is Inactive and does not allow to file the GSTR 9 Return

Solution

GSTR 9 ‘Proceed to File’ button will get enable only after clicking on ‘Compute Liability’ button. This action will calculate any additional tax liability after entering data in GSTR 9 return data

Issue no. 3

How to treat wrongly availed ITC availed and reversed in GSTR 9 Return?

I have availed ITC in September 2017 in Form GSTR 3b and by mistake in October 2017 (.i.e claimed ITC twice for the same inward supply)/. However I have reversed the same in form GSTR 3B of November 2017. While filing GSTR 9 how can I correct the same. Whether table 6B is to be filled for correction.

Solution

In table 6B of GST ANNUAL RETURN IN GSTR 9, you have to enter ITC for inward supply only once.

Since table 8B is auto populated from table 6B abd 6H, no further action is required from You. Alternatively, you can also reverse ITC by reporting it in GST ANNUAL RETURN IN GSTR 9 table 7.

Issue no. 4

Can I avail ITC of 2017-18 while filing GST ANNUAL RETURN IN GSTR 9?

I could not claim ITC for fy 17-18 upto March 2019 in from GSTR 3B returns. Can I claim it in form GST ANNUAL RETURN IN GSTR 9 now.

Solution

No, there is no provision to claim ITC through form GST ANNUAL RETURN IN GSTR 9. Form GST ANNUAL RETURN IN GSTR 9 is merely a consolidated statement of all the Annual Returns and also provides you with an opportunity to discharge pending tax liabilities.

Issue no. 5

ITC for goods or services received in the previous financial year could have been availed in returns filed for the months of April to September of the current financial year or date of filing of Annual Return for the prev

Where should I declare ITC & Whether Table 4(A) of form GSTR 3B may be used for filing up these details?

Solution

yes, you can dec

ITC of 2017-18 if not claimed by due date of return of march 2019 (extended from Sept. 18 to march 19) cannot be claimed therafter.

Remember to include ITC in form 3B before filing Annual Return in GST ANNUAL RETURN IN GSTR 9.

Issue no. 6

If I have overvalued my sales for the f.y 17-18 and amended those values in FY 18-19, where can I enter this information in GST Annual return in GSTR 9?

Solution

you can enter this information in table 11 of GST ANNUAL RETURN IN GSTR 9.

Issue no. 7

How should a taxpayer calculate interest amount while making entry in table 14 of GST ANNUAL RETURN IN GSTR 9?

Solution

As per section 50 of GST law, the taxpayer is required to calculate interest separately under each Act i.e IGST, CGST, SGST & compensation cess and enter the consolidated amount in table – 14 of form GST ANNUAL RETURN IN GSTR 9.

Issue no. 8

What is separately declaring inputs, input services & capital goods in table in GST annual Return?

Solution

Here you will have to segregate the ITC availed under following heads, depending upon the use of such inward goods or services:

- ITC on inputs

- ITC on capital goods, and

- IT

C on services

You need to enter each type in table 6 of GST annual return in GSTR 9 Separately.

Issue no. 9

In GSTR 9 inward and outward, is HSN summary mandatory or not and what is limit on turnover for such declaration

Solution

In table 17( outward supplies) for turnover up to Rs. 1.5 cr, HSN wise summary is optional. However, for turnover between R.s1.5 crorer to 5 Cr. 2 digit HSN summary is mandatory.

Also, for turnover over Rs. 5 cr. 4 digit HSN summary is mandatory. According to the present instructions HSN wise summary details in table 18 of inward supplies, account for 10% or more independently in value terms Is required to be furnished.

Issue no. 10

Can I edit details in GST annual Return after clicking on Compute liability?

Solution

yes, one can edit details at any time before filing GSTR 9 annual return.

Issue no. 11

The data of GSTR 2A is not reflecting correctly in GSTR 9. Generally it shows less data. What is the reason behind this?

Solution

This can be because of below reasons:

- The GSTN software updates the data periodically from GSTR 2A to GSTR 9. Therefore you need to check when it was updated last. You can see that while filing GSTR 9.

- The ITC of inward supplies on import of goods, import of services, tax paid on RCM basis will not populate in GSTR 2A. Thus, it will not update in GSTR 9 also. However, taxpayer is eligible to avail ITC on above types of goods and services. Therefore, one needs to enter them manually in GSTR 9.

- There may be difference because of place of supply. For eg. Supplier may have shown the interstate invoice as Intra-state and vice versa while uploading it in GSTR 1.

- Thus, taxpayer needs to enter actual data, based on their books of account or returns filed during the financial year.

Issue no. 12

How to treat, if I have availed ITC in GSTR 3B return but my supplier did not upload it in GSTR 1 and its not reflecting in GSTR 2A and GSTR 9?

Solution

Central board of indirect taxes and customs has clarified this earlier through the press release. Saying that” it may be noted that auto-popluation is functionality provided to taxpayers for facilitation purposes, taxpayers shall report the data as per their books of account or returns filed during the financial year.”

However, ITC claimed shall be settled by tax authorities as per the provisions of section 16, 17 & 18 of GST law.

Issue no. 13

Non-GST inward supplies and exempted supplies option is not available in GSTR 9 and GSTR 9A return.

Solution

There is no requirement to show the inward supplies of exempted and

However, HSN wise summary to be provided in table 18 of GSTR 9 return, if the total inward supply exceeds 10% of the value.

Frequently Asked Questions

Ans: Every person registered as a normal taxpayer is required to file GSTR 9, irrespective of their turnover.

However, Every registered person whose turnover has been more than 2 crores rupees during the financial year needs to file GSTR 9C. Secondly, such taxpayers need to make an audit of their accounts through a chartered accountant or cost accountant. Thereafter, they need to submit a copy of audited annual accounts and reconciliation statements electronically as and when available.

Yes, it’s compulsory to file GSTR 9 return for normal taxpayers. Learn how to file GSTR 9 online on the GST portal.

1. If you are a regular or composition taxpayer for the part period during the financial year then you need to file both GSTR 9 and GSTR 9A for the respective period.

2. For example You need to file a GSTR 9A return, If your Composition scheme registration period starts on 01.07.2021 and ends on 31.12.2022.

3. On the contrary, you need to file GSTR 9, if you opt for the normal or regular taxpayer from the Composition scheme. We assume that you register as a normal taxpayer from 01.01.2018 to 31.03.2018. Thus, you have to file GSTR 9 return for the period from January 01, 2018 to March 31, 2018.

Yes, you need to file an annual return under GST even if you got your GST registration canceled during the said financial year. Read step by step guide to know how to file gstr 9 online gst website.

No, In order to file GSTR 9 you must have active GSTIN during the financial year. Similarly, you must file GSTR 1 and GSTR 3B returns before proceeding to file GSTR 9.

On one hand, you can file Nil return only if you have not made any outward supply and not received any goods and services.

On the other hand, you can file a return if you have no other liability to report and have not claimed any ITC during the financial year.

Also, if you have not claimed any refund, not received any order creating demand and there are no late fees paid or payable during the year.

1. One needs to pay late fees for late filing of a GSTR 9 returns. Secondly, you cannot file GSTR 9 return without payment of a late fee, if the same is filed after its due date.

2. Similarly, you will get a link to navigate to form GST DRC 03 to pay tax if any. Thus, any additional payment of tax can be made using this form. Please note that You can make such payments only through Electronic Cash Ledger. Read the above steps on how to file gstr 9 online before proceeding to file your annual return.

Yes, you can declare any additional liability in GSTR 9, which does not exist in Form GSTR 3B. Thus, you need to pay such additional liabilities of Form GSTR-3B through Form GST DRC-03 only.

You cannot claim an input tax credit (ITC) through GSTR 9 return.