The government has integrated e Way Bill system with the Vaahan system of the Transport Department. This is the future e concept for e way bill verification. Thus here is the list of 8 things to know about E-way Bill linking with the Transport Department.

- The new system will verify the Vehicle (RC) number entered in the e way bill with Vahan data to check its correctness. Thus, if it does not match the data then the user will see an alert to check and correct.

- The taxpayer will not able to generate e waybills if the RC number is not correct as per the Vahan database. Thus, the taxpayer e needs to update the vehicle number in the Vahan database to generate e waybills in the future.

- If the vehicle number is not available in the Vahan system user will see an ‘Alert Message’ about the non-availability of vehicle number in the Vahan database. Therefore, the system will not allow generating the e-way bill for such vehicle numbers.

- The user/taxpayer needs to check and update the vehicle registration with the concerned Regional Transport Office (RTO). In case he fails to do so the vehicle number will not be allowed for e-way bill generation.

- Vahan System is available for the nationwide search of the vehicle over the digitized data of Registered Vehicles. Therefore, for checking whether vehicle number is available in Vahan system or not, one can always check the vehicle number in Vahan system at https://vahan.nic.in/nrservices/faces/user/searchstatus.xhtml

- In case, Vehicle number entered in the e-waybill is registered and the system still showing ‘Alert Message’ it is suggested to reach the concerned RTO. Once the vehicle details are updated in the Vahan system, the status in the e-Waybill system will subsequently get updated.

- If the Vehicle number is with temporary registration, the details are not verified and one should enter the temporary number starting with TR.

- In case the details of vehicle numbers are shown on the Vahan website, however, in the e-way bill portal it shows not available, one can contact the E-way bill Helpdesk and submit his grievance by specifying the Vehicle number which is there in Vahan system but not available in e-way bill portal.

Currently, the Pilot run of Vehicle Number Verification is implemented for Karnataka state only.

E way bill portal Enhanced with Top 5 changes from April 23rd, 2019

25.04.2019: E

You must be aware of these changes so that you can prepare yourself while generating an e way bill for the future. The system has put automatic restrictions without manual interference of user, so that the user can not violate the GST rules. Here are the broad changes that you can see now.

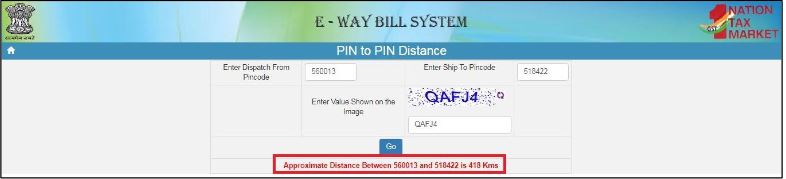

1. Automatic Distance Calculation based on PIN Code

The

If the source PIN and destination PIN are the same, then the user can enter only up to a maximum of 100 kilometers. If the entered PIN is incorrect, the system will alert the user as a random PIN code but they can continue to enter the distance. Such e-Way bills with the wrong PIN code, will be highlighted to the departmental officers for the review purpose.

2. No multiple e way bills for single invoice

Any driver, cargo or transporter, is not allowed for the creation of multiple e-bill bills based on a single invoice. That is, once an e

3. Extension of e way bill validity

The Transporters have requested the government to extend e way bill validity when the goods are in transit. Transit means goods can be on the road or in the warehouse. During the extension of validity of e

Further, if he selects as In Movement the E

4. No eway bills to composite dealers for interstate supplies

According to the GST law,

Therefore, composite dealers will not be allowed to generate e-way bill for inter-state movement of goods on eway bill system.

Similarly, the composition taxpayer will not be allowed to enter any taxes under CGST or SGST

5. E way bills about to expire report

Taxpayers and transporters can now view the list of e Way Bills about to expire in 4 days time. This will facilitate them to keep track of expiry dates for each of the consignments generated. Also, they can ensure that the consignment reaches within the time limit.

How to see e way bill Expiry report

The Taxpayer can

Top 7 E way bill system changes to help you

After studying the suggestions and responses of the investors of the e-way billing system, it has been decided to add the following changes/improvements in e-way bill system to help taxpayers comply with GST procedures and rules.

Most of them are verification for existing fields so that users can get help to enter correct values. It is proposed to start these changes in a phased manner in the coming weeks.

Taxpayers and transporter can go through these upcoming changes/improvements, understand and prepare them for their own use.

1. Validation of tax rate during E way bill entry

The system is being enabled to check rates by the system. The taxpayer now will able to enter the standard GST tax rate fixed by the GST Council. This will avoid data entry mistakes by taxpayers.

However, tax rate entry is optional. If it has been entered, it will be verified. The following list of tax rates will be validated.

CGST (%): 0; 0.05; 0.125; 1.5; 2.5; 6; 9; 14.

SGST (%): 0; 0.05; 0.125; 1.5; 2.5; 6; 9; 14.

IGST (%) : 0; 0.01; 0.25; 3; 5; 12; 18; 28.

Cess – Ad valorem (%) : 0 or 1 or 3 or 5; or 11 or 12 or; 12.5 or 15 or 17; or 21 or 22 or 36; or 49 or ; 0 or 61; or 65 or 71 or 72; or 89 or 96 or ; 142 or 160 or; 204 or 249

Cess – Non Ad valorem (%) : 0; 400; 2076; 2747; 3668; 4006

2. PIN code validation

The system is being enabled with populating the state name based on the entry of the PIN code. If the same PIN code is related to the address of many states, then the user will be able to select the appropriate state code.

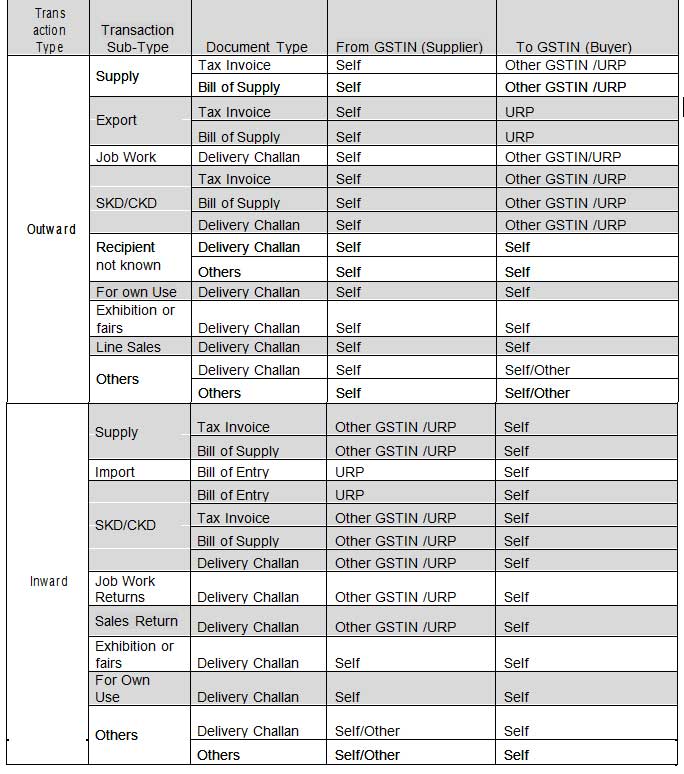

3. Supply type Validation with Document Type

In order to facilitate taxpayers further and to select proper type of document type, e way bill portal is configured as per below option. Please see the table below for details of supply types. The supply types will be available according to the document type. This system also defines the types of suppliers and buyers involved in this supply type.

If supplier e-bills are generating bills, then verification is done. If the transporters or cargoes are producing e-bills, then the columns relating to ‘GSTIN (Supplier)’ and ‘GSTIN (Buyer) Verification will change accordingly.

4. Blocking for the creation of multiple e-way bills for same Invoice Number

According to the receipt of feedback’s from some taxpayers, the system is being able to block the generation of multiple e-bills for the similar invoice number, if the taxpayer generates for the same invoice number as in the past. Now the system will allow to generation one e way bill per invoice.

However, if multiple e-bills are being generated on the same invoice by the transporter or consignee, then the system will alert him and if necessary, e-will allow the bill to be issued.

This facility is being provided to ensure that if the original invoice available with the correct number is available with the transporter. Later the transporter can continue with the e way bill production and transfer the goods. This will not hamper the movement activities of the transporter.

5. ‘Bill To – Ship To’ Transactions

The system is being simplified to capture the details of the ‘Bill to – Ship to’ transactions. The system will ask for the following details.

1. Category: Regular OR Bill to – Ship To OR Bill From – Dispatch From OR Both

2. GSTIN and Name of Dispatching Party, if the category is ‘Bill From – Dispatch From’ or ‘Both’

3. GSTIN and Name of Shipping Party, if the category is ‘Bill to – Ship to’ or ‘Both’

However, the parameters of serial number 2 and 3 are optional.

Advertisement

6. Making GSTR-1 Return data compulsory for users of API and Offline (Excel) tool

The users of API and Offline tool are being enabled’d to transfer the information related to Form GSTR 1 (that is, rates of tax and tax values) data compulsorily with e-way bill basic data, before generating the e-way bills.

7. Auto-population of distance between ‘From PIN Code’ and ‘To PIN Code’

According to the reaction of most investors, the system is being able to display and limit the distance between the starting pin code and the destination pin code (in KM). In the e-way bill system, the distance between all the zip codes and distance (in KM) of the country is available. This will get populate automatically while entering the starting and destination pin code. This will ease the job of calculating and entering the distance between consignors place to consignee place.