Learn about GST New return to be applicable from April 2020. Know how to file and how to select GST’s new return. Also, know the filing frequency and rules of these new return system. Thus, there are three types of New GST returns in this system which are as follows:

The first one is GST RET 1 which has to be filed on a monthly basis by the taxpayers whose previous year turnover is more then 5crore rupees. This return can also be filed on a quarterly basis by those, whose turnover is upto 5 crore in previous year.

Further, GST RET 2 and RET 3 are quarterly returns with minimum features as explained below. These returns are suitable for those taxpayers whose type of transactions are limited and the turnover is below 5 crore rupees. You will learn them in the below section. Let us see them one by one.

GST New Return Format

As of now, the GST news returns formats are available only for annexures i.e Annexure 1 and 2. The offline excel formats of RET 1, RET 2 or RET 3 are not yet available on the portal. Thus, you can download the GST RET 1 format in Excel from here.

Also, you may download GST RET 2 format from here. Similarly, If you want to download the pdf formats of GST New Return, you may click here. Please note that the excel formats are contained in the downloaded offline tool.

GST New Return Rules

Here is how to select New GST Returns?

The GST new returns will be applicable for filing from April 2020. The taxpayers will have to file either GST RET 1, GST RET 2 or GST RET 3. Further, there are options for filing these returns on a monthly and quarterly basis. Therefore, it becomes very important to select which return to file?. Thus here you can find out which return you should opt to file and choose whether you are eligible to file it monthly or quarterly basis.

GST RET 1 – Monthly filing Eligibility Criteria

The GST RET 1 is also known as Monthly (Normal) return in New GST return filing system. In order, to opt for this type of fling the taxpayer shall meet the below requirements.

- Aggregate turnover during the preceding financial year is up to Rs. 5.00 Cr AND

- A taxpayer is making supplies only to consumers, (B2C) or/and

- Have inward supplies on which tax is payable on a reverse charge basis (RCM)

GST RET 1 – Quarterly filing Eligibility Criteria

This is also known as Quarterly (Normal) return. Below are the requirements to opt for this system.

- Aggregate turnover during the preceding financial year is up to Rs. 5.00 Cr

- The taxpayer is making all kinds of supplies, including reverse charge supplies.

GST RET 2 – Quarterly filing Eligibility Criteria

This return is also known as SAHAJ return.

- Aggregate turnover during the preceding financial year is up to Rs. 5.00 Cr

- A taxpayer is making supplies only to consumers, (B2C) or/and

- Have inward supplies on which tax is payable on the reverse charge basis (RCM

Note: You cannot claim provisional ITC on Missing invoices

GST RET 3 – Quarterly filing Eligibility Criteria

This return is also known as SUGAM.

- Aggregate turnover during the preceding financial year is up to Rs. 5.00 Cr

- The taxpayer is making outward supplies to registered persons (B2B) & supplies to consumers, (B2C) and

- Have inward supplies on which tax is payable on the reverse charge basis (RCM)

Note: You cannot claim provisional ITC on Missing invoices

All types of taxpayers filing quarterly returns shall make the payment on a monthly basis through PMT 08.

Switch over from Quarterly (Normal) to RET 2 or RET 3

If the return filing frequency is chosen as quarterly, then the taxpayer can change the return type as either Quarterly (Normal), RET 2 (Sahaj) or RET 3(Sugam), based on the types of their transactions. However, the taxpayer whose aggregate turnover was more than Rs. 5 crores, in the preceding financial year, has to file Monthly (Normal) return.

How to change the filing frequency?

To change return filing frequency, navigate to Returns > Manage Return Profile (Trial) > Change Return Frequency.

GST New Return Trial

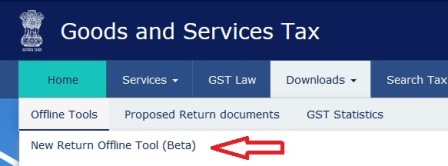

As of now, the new return system is available for trial. Thus you can download the offline tool and upload the details on the GST portal. With the help of the below tool, you can prepare GST ANX 1 and ANX 2. You can generate the JSON file of these annexures and upload it on the portal. kindly note you can not file these annexures. Thus you need to only upload it.

GST Council Secretariat fixed target for states for a trial use of new return system

23.10.2019: Recently the CBIC extended the GSTR 3B and GSTR 1 filing due dates till 31.03.2019. Therefore, the government plans to implement GST Anx 1 and GST Anx 2 from 01st April 2020. Earlier it said from October onward GST ANX 1 and ANX 2 will be made compulsory as per trailing press release.

On 11th October 2019, The GST council issued office memorandum giving 10lakh target to upload Anx 1 Anx 2 on a trial basis. This memorandum is given to all state commissioners of Commercial Taxes. Therefore, states are instructed to provide adequate guidance to taxpayers in uploading GST Anx 1 Anx 2 on a trial basis. Also, the GST council has asked the officers to submit their trial success report to the Secretariat at the end of each month.

As a taxpayer, you may receive an email intimation to attend the outreach programme in this regard. you may read the office memorandum to read it further in detail.

Sahaj and Sugam GST Return for Small taxpayers in India

12.09.2019: The ministry of finance has issued a press release on New GST return to be made compulsory form October 2019. The new GST Return GST Anx-1 to replace GSTR 1 Return soon. Also, GST PMT-08 to replace GSTR 3B monthly Return. The trial version of GST Anx 1 and ANX 2 is now available on the GST portal for testing purposes. You may visit the GST portal and Click on the “New Return(Trial)” option and follow the instructions for demo.

Earlier in the 31st GST council meeting, it was decided to introduce a new GST return to facilitate taxpayers. Read below the complete press release.

About GST Council Meetings and Return process until Now!

The 28th GST council meeting has brought good news to the taxpayers with regards to the filing of Sahaj and Sugam GST Return. The recommendations of simplified return came under the chairmanship of Shri Piyush Goyal, Union Minister for Railways, Coal, Finance & Corporate Affairs.

In the previous GST council meeting held on 04th May 2018, the council had approved the basic principles of GST return and instructed the law committee to finalize the return format and suggest necessary changes in the law.

In the 28th Council meeting, these formats and business processes got approval and found in line with the basic principles. There is one major change suggested in the said process ie. The option of filing the quarterly return with monthly tax payment in a simplified format for small taxpayers.

It is further said that small taxpayers, Input service distributors, etc shall fine quarterly return and rest shall file a monthly return.

About Simple Return Scenario- UPLOAD – LOCK – PAY”

The simple return will have two main tables. One table is for showing outward supplies and the other is for availing input tax credit. On the other hand, an Input tax credit will be based on the invoices uploaded by the supplier. Also, the Council has kept the same previous process for continuous uploading of invoices by the seller. This enables the receiver to view the invoices and lock them for availing input tax credit.

GST Council wants to be sure that all taxpayers return will get automatically file on the basis of invoices that exist in the return by the buyer and the seller. This process will likely to be said as” UPLOAD-LOCK-PAY for most of the taxpayers.

It further says that the taxpayer will have the facility to create his own profile based on the nature of supplies made and received. Secondly, the taxpayers whose returns are nil will have the facility to file the return by simply sending one SMS. This is a very advanced and good decision because everyone need not have to play with the GST portal.

Quarterly Return V/S Monthly Return

The GST council has given approval for quarterly return filing for the small taxpayers having turnover below Rs. 5 crore as an optional facility. The quarterly return shall be similar to the main return with the monthly payment option. This facility will be available for small traders who make B2C transactions or who make B2B + B2C supply.

About

Council has designed a simple return called Sahaj and Sugam for small taxpayers. At the same time, Small taxpayers will be requiring to fill less data information compared to regular return filers.

The new return proposal provides a facility for amendment of the invoice and also other details filed in the return. The taxpayer will have to file a separate return called GST Amendment Return to make the changes in the previous return.

Payment of tax will be allowable through the amendment return as it will help save interest liability for the taxpayers.

Categories of Taxpayers

93% of the taxpayers are with a turnover of less than Rs 5 Cr. Therefore these taxpayers will benefit substantially from the simplification measures, by improving their ease of doing business. Also, the large taxpayers will find the design of a new return quite user-friendly.

Kindly note, this is only the press release. Official notification will follow once it is ready for implementation. Keep visiting GST India News for further updates on GST Returns. Also, click on the subscribe button to receive

GST New Return FAQ

The GST new return will have to file in GST RET 1, RET 2 and RET 3.

While submitting these returns the taxpayers will have to add ANX 1 and Anx 2 to the above returns.

The new return is currently in trial mode. Therefore, the government is only pushing to submit ANX 1 and ANX 2 as of now as a test. There will be no link on tax liability declared in ANX 1 with your GSTR 1. Similarly, the input tax credit declared in GST ANX 2 will also have no link with that of in your GSTR 3B return.

you can download it by visiting on GST portal as shown in the picture. Kindly extract the compressed file and open GSTNewReturnsOffline_beta_v0.5.exe. This will install the setup of a new return.

April 2020

You need to file Either GST RET 1, RET 2 or RET 3 with Annexure 1 and 2.