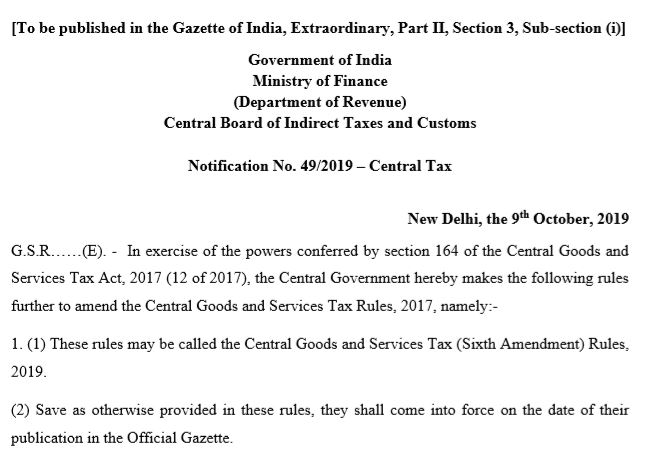

The CBIC has issued a CGST notification no. 49/2019 dt.09.10.2019 to make certain changes in CGST Rules. These rules are to be effective from 09.10.2019. The major changes you will see in the input tax credit system. Let us see one by one.

1. Explanation added to Suspension of registration Rule no. 21A:

Rule no. 21A explains what happens after the taxpayer applies for GST Cancellation. According to this rule, as soon as the taxpayer applies for the cancellation of registration, the registration deemed to suspended.

Therefore, the explanation here is, the taxpayer shall not issue any tax invoice nor shall charge any tax on outward supplies he makes during the period of suspension.

2. Supplies made during the time of suspension period

A sub

3. Input Tax credit, not more than 20%

Sub-rule (4) has been inserted under rule 36, which put conditions to avail input tax credit. The new rule says, an input tax credit availed by the taxpayer on the invoice and debit notes shall not exceed more than 20%, then that of appearing in GSTR 2A return.

In other words, the recipient of goods or services can avail only 20% Input tax credit on inward supplies if they are not appearing in GSTR 2A.

For eg. The receiver has Input tax credit invoices amounting to Rs. 5 lakh. However, the supplier has uploaded invoices of only worth Rs. 3 lakh. Therefore, in this case, the recipient can avail input tax credit of Rs. 3.60 lakh only, although he as invoices of Rs. 5Lakh.

3. Submission of monthly Returns

The person required to file GSTR 3B shall not require to file GSTR 3 Return. This is applicable from 01.07.2017 i.e from the GST launch date in India.

4. GST Practitioner to pass Examination

The GST practitioner shall pass the examination within 2 years of its enrolment.

5. GST Refund disbursement

The Central Government will disburse the GST refund based on the consolidated payment advice issued under sub-rule (3) of Rule 91. This will be applicable from 24.09.2019.

6. Intimation of tax ascertained to the taxpayer

In cases of Inspection, search, seizure, and arrest, the officer shall communicate the details of tax, interest,

Refer CGST Notification No. 49/2019 dt.09.10.2019 for more details.

Download CGST Rules as on 01.04.2019 Amended Version

01.04.2019: The government has uploaded the

Also, you can download updated GST forms as per the latest changes made in CGST rules.

Please click here to download..

Top 6 Amendment in CGST Rules (Eight Amendment) 2018

This time government has made the eighth amendment in its CGST Rules. The government has issued a Notification No. 39/2018 – Central Tax dt. 04.09.2018 in this regard. Below are the major changes you should be aware of.

Please download CGST rules in pdf format to read with below changes. Here are the top major changes.

1. Amendments in Rule: Cancellation of Registration Process

The government inserts following lines In rule 22, in sub-rule (4).

“Provided that where the person instead of replying to the notice served under sub-rule

(1) for contravention of the provisions contained in clause (b) or clause (c) of sub-section

(2) of section 29, furnishes all the pending returns and makes full payment of the tax dues along with applicable interest and late fee, the proper officer shall drop the proceedings and pass an order in FORM GST-REG 20.”.

2. Amendments in Documentary proof requirement for claiming input tax credit rule

The government inserts following lines In rule 36, in sub-rule (2).

“Provided that if the said document does not contain all the specified particulars but contains the details of the amount of tax charged, description of goods or services, total value of supply of goods or services or both, GSTIN of the supplier and recipient and place of supply in case of inter-State supply, input tax credit may be availed by such registered person.”.

3.Amendment for Transportation of goods without an issue of invoice

The government replaces after the words “completely knocked down condition”, the words “or in batches or lots” In rule 55, in sub-rule (5).

4. Amendments in Application for refund of tax, interest, penalty, fees or any other amount.-

Further, The government inserts below lines in rule 89, in sub-rule (4), for clause (E).

‘(E) “Adjusted Total Turnover” means the sum total of the value of-

(a) the turnover in a State or a Union territory, as defined under clause (112) of section 2, excluding the turnover of services; and

(b) the turnover of zero-rated supply of services determined in terms of clause (D) above and non-zero-rated supply of services,

excluding-

(i) the value of exempt supplies other than zero-rated supplies; and

(ii) the turnover of supplies in respect of which refund is claimed under sub-rule (4A) or sub-rule (4B) or both, if any,

during the relevant period.’.

5. Amendments in Refund of integrated tax paid on goods [or services]55 exported out of India.-

The government replaces the words with effect from the 23rd October 2017 in rule 96, for sub-rule (10).

“(10) The persons claiming a refund of integrated tax paid on exports of goods or services should not have –

(a) received supplies on which the benefit of the Government of India, Ministry of Finance

notification No. 48/2017-Central Tax dated the 18th October 2017 published in the Gazette of India, Extraordinary,

Part II, Section 3, Sub-section (i), vide number G.S.R 1305 (E), dated the 18th October 2017 or notification No.

40/2017-Central Tax (Rate), dated the 23rd October 2017 published in the Gazette of India, Extraordinary, Part II,

Section 3, Sub-section (i), vide number G.S.R 1320 (E), dated the 23rd October 2017 or notification No. 41/2017-

Integrated Tax (Rate), dated the 23rd October 2017 published in the Gazette of India, Extraordinary, Part II, Section

3, Sub-section (i), vide number G.S.R 1321 (E), dated the 23rd October 2017 has been availed; or

(b) availed the benefit under notification No. 78/2017-Customs, dated the 13th October 2017 published in the

Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1272(E), dated the 13th

October 2017 or notification No. 79/2017-Customs, dated the 13th October 2017 published in the Gazette of India,

Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1299 (E), dated the 13th October 2017.”.

6. Information to be furnished prior to the commencement of movement of goods and generation of e-way bill.-

The government also inserts below lines in rule 138A, in sub-rule (1).

“Provided further that in case of imported goods, the person in charge of a conveyance shall also carry a copy of the bill of entry filed by the importer of such goods and shall indicate the number and date of the bill of entry in Part A of FORM GST EWB-01.”.

a) Substitution of form GST REG-20 in said rules.

b) Substitution of form GST ITC-04 in said rules.

c) Insertion of the FORM GSTR 9 (Annual Return) and GSTR 9A (Annual Return (For Composition Taxpayer) after FORM GSTR-8,

Kindly refer CGST Rules in PDF, for above forms. These are the Top 6 Amendment in CGST Rules (Eight Amendment).

Please subscribe to receive gst latest news updates directly in your inbox, as and when we publish new post. Do not forget to add admin@gstindianews.info email address in your address book. GST India news provides gst latest news with notification.